The bulk of the demand for music in Germany proceeds from private households, which spent some €6.7 billion on music in 2016, or roughly 6 per cent of the population’s total outlay for leisure, education and entertainment. This amount includes expenditure not only on various forms of music consumption (concerts, recordings, digital products), but also for items and services required for active music-making: sheet music, musical instruments and music lessons. Here some €2.4 billion were spent in 2016. In comparison, music consumption accounted for two-thirds of the demand (€4.3 billion). [1]

But music is also sought by companies outside the music economy for use in their own products. It is indispensible, for example, for most radio broadcasts, motion pictures, TV movies, promotional videos and computer games. The magnitude of the companies’ demand for music (mainly recordings) can be seen in the income flows of Germany’s two major performance rights associations, the Society for Musical Performance and Mechanical Reproduction Rights (Gesellschaft für musikalische Aufführungs- und mechanische Vervielfältigungsrechte, or GEMA) and the Collecting Society for Performance Rights (Gesellschaft zur Verwertung von Leistungsschutzrechten, or GVL), which together collected roughly €1.2 billion in rights income from Germany and abroad in 2016. Of this, slightly more than a third came from the so-called secondary rights market, i.e. from companies that further exploit music recordings for their own business models (radio and TV producers, filmmakers, video clip manufacturers, clubs and so forth).

The music economy comprises all business enterprises (including the self-employed) whose activities contribute to satisfying the demand for music from private households and companies. It has three basic features:

- A large portion of the total offerings, especially in music teaching and live concerts, is produced by non-profit publicly funded entities. According to statistics published by the German Theatre and Orchestra Association (Deutscher Bühnenverein) and information from the Association of German Music Schools (Verband deutscher Musikschulen, or VdM), the public sector achieved total income of €2.7 billion in 2016, two-thirds of which came from public subsidies. This amounts to roughly a quarter of the total revenue of all private music companies. The approximately 47,000 employees in Germany’s publicly funded theatres, orchestras and music schools amounted to slightly more than a third of the workforce of private companies in the music economy. [2] Nevertheless, the conventions of economic statistics preclude their being assigned to the music economy.

- Germany’s music economy consists almost entirely of small and medium-sized companies or microenterprises (self-employed persons with no employees). Only a small number of companies attain annual revenue of €50 million or more. Among the latter are several large producers of audio recordings [3] (record labels) [4] as well as concert organisers and record pressing plants. Many of the small and medium-size companies are active in more than one subsegment.

- Music production in its entirety, up to and including sale to end customers, is organised by sharply divided responsibilities within complex value chains. For example, music recordings usually emerge in a co-operative effort between sound record producers and specialised suppliers (pressing plants, sound studios, music producers). Their sales are organised via the producers’ own marketing departments and specialised companies in the wholesale and retail trade. Similar value chains exist for live music and the manufacture and marketing of musical instruments and accessories.

Which companies belong to the music economy as a whole is a much-debated question. In the ‘official’ definition by the economic ministers of the German states, the music economy is called the ‘music market’ (Musikmarkt), and all companies in certain branches of the economy are assigned to it. The precise selection of these branches is part of an overall definition of Germany’s cultural and creative economy (Kultur- und Kreativwirtschaft, or KKW). [5] In general, freelancers are also treated as companies. The cultural economy includes all companies that are ‘primarily profit-oriented and concerned with the creation, production, distribution and/or media dissemination of cultural and creative goods and services’. [6] Employees in publicly funded entities (e.g. museums, theatres, orchestras, cultural and artistic associations or foundations) are included in the KKW’s annual monitoring reports (‘KKW Monitor’ [7] ) for information purposes only.

In the eyes of the music economy’s large professional associations, however, this definition is too narrow, for it omits such important economic activities as private music schools, freelance music teachers and individual performers among practicing musicians. A study of the overall impact of the music economy in 2015 (Musikwirtschaft in Deutschland, ‘MW Study’), [8] commissioned by ten professional associations inside the music economy, came to quite different conclusions from those of the KKW Monitor. Both sources must be taken into account and compared in order to obtain a fuller picture of Germany’s music economy.

Internal structure (sub-segments)

The economic figures in the publications of Germany’s Federal Statistical Office are based on a unified and internationally co-ordinated classification scheme for business branches (Wirtschaftszweige, or WZ). Any company that pursues several activities simultaneously is assigned to one of the branches depending on the main focus of its revenue. The WZ classification scheme also provides the basis for the definition of the music economy in the KKW Monitor. As some branches in the WZ scheme cover a very wide range of activities, the companies assigned there may have their main activities not only in the music economy but in other branches as well. Nonetheless, in the KKW Monitor, business branches are almost always assigned to the ‘music market’ only if their music business activities clearly predominate. [9] This causes many companies in the music economy to be excluded.

The above-mentioned MW Study therefore provides a broader definition of the music sector by combining 22 main activities into the following sub-segments:

- Creative artists. In the KKW Monitor this includes authors of works of music (composers, lyricists, songwriters, arrangers) as well as practicing artists, for which the official WZ classification scheme lists only one business branch for music groups. Individual performers are assigned alongside actors and other stage performers to the ‘independent theatre, film and television artists’ branch, which the KKW Monitor classifies with the film industry and the market for the performing arts.

- Music teaching. Unlike the KKW Monitor, the MW Study also assigns private music schools and freelance music teachers to this sub-segment. In contrast, the KKW Monitor excludes them from the music market and places them in the market for the performing arts.

- Live music. In the KKW Monitor, this sub-segment includes concert organisers and private music theatres. The MW Study also assigns companies with the following main areas of activity to this segment: concert agencies, organisers of guest performances, tour organisers operators of music clubs and larger venues and ticket services that handle a large part of advance ticket sales.

- Recorded music. In the KKW Monitor this sub-segment includes recording studios, record producers (labels) and record retailers. The MW Study expands it to include music producers, pressing plants, record distributors and other companies that deal in recordings and digital music products, whether in brick-and-mortar shops or online.

- Music publishers. The KKW Monitor interprets this to include those companies that handle domestic and foreign copyright claims for composers and lyricists on the basis of individual rights management contracts, plus Germany’s collecting societies GEMA and GVL. The MW Study, in contrast, assigns these two organisations to their own separate sub-segment.

- Musical instruments. Here the KKW Monitor assigns the builders and sellers of musical instruments, musical equipment and accessories as well as retailers of musical instruments and music supplies. In the MW Study this segment additionally includes manufacturers of stage and studio equipment for live and recorded music.

Economic importance and developments

The business activities of these various branches and sub-branches can be compared using indicators that allow us to measure the scale of each activity as uniformly as possible. Indicators frequently used for this purpose are the number of companies and their revenue within a branch. Admittedly the comparisons permitted by these two indicators are limited, for the average size of companies varies from one branch to another, and the total revenue of all companies provides only a superficial point of departure for measuring the scale of business activities, since branches may differ significantly in number of value creation stages. [10]

That is why branch comparisons in economic statistics are usually based on two parameters that avoid this problem of double counting. The first is the size of the workforce, including all permanent employees (generally the number of full- and part-time employees with social insurance plus the marginally employed) and all self-employed persons active in their own company. Freelancers active for short-term periods on a pro rata basis are not included. The Federal Employment Agency has a precise overview of employees based on contributions to the social insurance scheme. The number of self-employed in a given business branch is estimated on the basis of the annual microcensus by the Federal Statistical Office. [11] More precise additional data can be obtained for the music economy from the statistics of Germany’s social insurance scheme for artists, the Künstlersozialkasse (KSK). [12]

The most important indicator for determining the business activity of a branch is referred to, in the jargon of business statistics, as ‘gross value-added’. In essence, this is the total annual income in all the companies of the branch. It encompasses the profit income of the business owners plus employee income (wages and salaries). To determine the gross value-added, data is required on the revenue from each company in the sector and the value of all preliminary services by other suppliers.

‘Germany’s music economy consists almost entirely of small and medium sized companies or microenterprises’

Companies and revenue

According to the data from the KKW Monitor, in 2016 over 14,400 companies subject to turnover tax (i.e. with annual revenues exceeding €17,500) belonged to the music market. Their total revenue amounted to some €7.1 billion (see Fig. 1). Compared to 2010, the number of companies grew by 5 per cent and total revenue by 13 per cent. However, the insurance statistics of the KSK show that there is a large number of self-employed authors and practicing artists in music who earn less than €17,500 annually, and whose revenue is thus omitted from the KKW Monitor.

In contrast, if we follow the definition used in the MW Study, the companies in the music economy, taken together, earned nearly €11 billon in 2016, and thus significantly more than is stated in the KKW Monitor. This difference can be explained first by the annual revenues of self-employed persons who earned less than €17,500; second by the revenue from the Music Teaching segment; and third by the revenues of those companies additionally assigned to the Live Music, Recorded Music and Musical Instruments segments, all three of which are included in the MW Study.

Workforce and income

According to the data from the KKW Monitor, nearly 86,000 people were employed in music market companies at the end of 2016 (see Fig. 2). These included some 50,000 ‘core employees’ (full- and part-time employees with social insurance and self-employed with more than €17,500 in annual revenue) as well as nearly 22,000 ‘microbusinesses’ (less than €17,500 in annual revenue) and nearly 14,000 marginally employed workers. Compared to 2010, the size of the workforce has thus expanded by 7 per cent. [13] The KKW Monitor places the largest percentage of core employees in the Musical Instruments segment (25 per cent), followed by Live Music (23 per cent) and Creative Artists (20 per cent).

The MW Study arrives at a much higher figure than the KKW Monitor, namely, some 128,000 employees for the year 2014 (the KKW Report has 82,000, including 49,000 core employees). Once again the difference largely resides in the inclusion of the Music Teaching sub-segment, where 28,500 employed and freelance music teachers were active, including (according to the KSK) many with marginal annual incomes less than €17,500. The other difference is accounted for by including individual artists and employees from companies additionally assigned to other segments of the music economy in the MW Study (see above), both of which are excluded from the KKW Monitor. In this light, the largest percentage of workers falls on the Live Music segment (26 per cent), followed by Music Teaching and Creative Artists (both 22 per cent).

The KKW Monitor gives only an estimated total of €2.5 billion for gross value-added in the music market. It makes no attempt to subdivide company and worker income by music business segment. The MW Study provides information on the revenue and cost structures of 1,300 companies, which altogether generated €3.9 billion in gross value-added in 2014. Nearly half of this (€1.9 billion) was made up of company profits (including income of the self-employed), followed by some €1.8 billion in workers’ income and €200 million in depreciations. The largest percentage of income fell on Live Music (27 per cent), followed by Recorded Music (22 per cent) and Musical Instruments (19 per cent).

Areas of the music economy

Creative Artists

Creative artists in the music sector provide the economic foundation for all other music enterprises. Two groups must be distinguished – authors and artists – albeit with overlaps, for some practicing artists also write their own songs and compositions.

Among music authors are lyricists/songwriters, composers and arrangers who create new works or arrange existing music. Their intellectual property is protected by copyright law, so that their main source of income is generally obtained from licensing. Another important source of income is fees for commissioned works. Their rights are administered via music publishers or the relevant collecting society for authors’ rights, GEMA.

In the case of performing artists, a distinction can be made between individual performers, groups (bands, orchestras, choruses) and DJs who appear live or make recordings. Their main sources of income are fees and payments for concerts or from recording contracts. In the case of sound recordings, their creative property is protected by ancillary copyright, which is administered by the relevant collecting society, GVL.

The economic position of creative artists differs widely from one person to the next. Some well-known figures can earn large incomes from concerts and the sale of recordings or digital music products; unknown newcomers or artists in less popular styles must often live on a low income. Similar differences pertain in the group of music authors. A full picture can be obtained only by including, in addition to turnover tax statistics, the KSK’s data regarding the annual incomes of the persons it insures in the field of music.

According to the KSK figures, some 18,000 practicing artists were insured in the field of music in 2016, or roughly 1,100 more than in 2010. Their average annual income amounted to €12,650. Only about 150 individual performers, and about 280 music groups, had income exceeding €100,000 in 2016. Compared to 2010, the average annual income of performing artists had thus risen by 17 per cent. However, average wages in the overall economy rose 15 per cent during the same period. The situation of the roughly 4,300 music authors insured at the KSK is only marginally better. Their average annual income in 2016 was €18,700, or 22 per cent higher than in 2010. Of these, only some 650 had annual incomes exceeding €100,000 in 2016. In other words, very many active musicians in Germany cannot earn a living solely with their income from music and are forced to find work outside music in order to make ends meet.

Music Teaching

In addition to music teaching at general public schools, Germany’s private households also seek fee-based voice and instrument lessons on a large scale from public and private music schools and freelance teachers. According to the consumer polls of the Federal Statistical Office, nearly €1.6 billion were spent to this purpose in 2016, almost the same as in 2010.

The Music Teaching sub-segment includes private music schools and freelance teachers. In accordance with the conventions of the KKW Monitor, the revenue, workforce and gross value-added of the roughly 930 publicly funded music schools are not assigned to the cultural and creative economy. At the end of 2016 some 26,500 freelance music teachers were insured at the KSK. Compared to 2010, their number had risen by 21 per cent even though their financial situation is no less precarious that that of practicing musicians. Their annual income amounted on average to only €12,500 in 2016 (compared to 11,000 in 2010) and stemmed both from private lessons and from pro rata contracts with private and public music schools.

Of the many freelance suppliers, 340 private music schools were organised in the National Association of Free Music Schools (Bundesverband der Freien Musikschulen, or bdfm) in 2016. According to figures from bdfm, these schools taught 158,000 pupils altogether in 2016, including pupils from co-operating institutions. Extrapolating from the figures in a poll conducted for the MW Study, their revenue amounted to an estimated €305 million. Altogether the schools employed 6,300 teachers, mostly on a pro rata basis. [14]

The publicly funded music schools organised in the Association of Music Schools (VdM) taught a total of 1.45 million pupils in 2016 and achieved total revenues of some €950 million. Roughly half of the revenues was made up of subsidies from public entities; another €450 million were earned from fees for instruction, i.e. some 12 per cent more than in 2010. [15]

Live Music

In 2000 consumer expenses for concerts and audio recordings were still roughly equal. Since then, with the steep downturn in demand for sound recordings beginning in 2000 (see below) and the sharply rising expenses for concerts, this ratio has shifted noticeably in favour of live music. The Consumer Research Society (Gesellschaft für Konsumforschung, or GfK) was commissioned by the National Association of the Event Industry (Bundesverband der Veranstaltungswirtschaft, or bdv), one of Germany two professional associations for concert organisers and agencies with some 240 members, [16] to determine the expenditures in its branch for 2016. The results were roughly €3.7 billion spent on some 71 million tickets for musical events, including €1.04 billion on classical concerts, opera and operetta, and another €0.65 billion on musicals. [17] Compared to 2009, this meant an increase of more than €1.4 billion, or 60 per cent. In short, music consumers spent more than twice as much on live concerts as on audio recordings and digital music products in 2016 (see below). Owing to the steep rise in ticket prices (70 per cent since 2009), and despite a downturn in the number of concertgoers, the Live Music sub-segment recorded the greatest growth of revenue in the music economy. For the coming years the bdv assumed that the growth curve will tend to level off as audiences become less willing to pay even higher prices for tickets.

The concert organisers, guest performance organisers and artists’ agencies in this sub-segment represent different types of enterprise: [18]

- Pride of place in the value chain for music events goes to concert organisers. [19] Festival organisers take care of various concerts in a single location or region; tour organisers manage concerts by the same artists at several locations. The latter work with so-called ‘local organisers’ at the various event sites. These local organisers receive part of the box-office proceeds for their organisational and marketing work. Some concert organisers manage their own venues. Here it is meaningful to distinguish between venues with up to 1,000 qm of floor space (clubs) and large venues, e.g. multi-purpose auditoriums. Private music theatres with their own venue and staff represent another type of organiser.

- Guest performance organisers and artists’ agencies serve an important function. The former, as proprietary companies, ‘deliver’ artists whom they have placed under contract to organisers for use in their events. In contrast, artists’ agencies do not work under their own name, but in the names of the artists who retain them, often on the basis of contracts of employment. Their task is to acquire opportunities for concert appearances for their clients and to conclude the relevant contracts. Their main sources of income reside either in commissioning fees from the revenues of the concert organisers or in payments from the musicians they represent. This middleman service is standard practice, especially in classical music.

Recorded Music

The introduction of audio compression techniques, such as MP3, and the growing use of the internet have fundamentally altered the way recorded music is distributed and perceived. From 2000 to 2012 Germany witnessed a massive collapse in private demand for audio recordings, from €2.6 billion in revenue to a mere 1.5 billion. Since then the total market has again begun to grow, but only by €100 million up to 2016. At the same time the demand has increasingly shifted from physical recordings to digital products, and again from downloads to streaming. In 2016, according to information from the Federal Music Industry Association (Bundesverband Musikindustrie, or BVMI), nearly a billion euros were spent by private households on physical audio recordings, and roughly 600 million for digital music, including 385 million alone in subscription fees for music streaming services. Audio streaming thus became, for the first time, the second most powerful revenue segment after CDs. Digital downloads made up only 12 per cent of the overall market.

The Recorded Music segment encompasses all areas in the production, duplication and marketing of physical audio recordings and digital music products. At the centre of the Recorded Music value chain are the roughly 400 producers subject to turnover tax, many of which own more than one label. The market for sound recordings and digital products has been dominated for decades by a few globally active ‘major labels’. The market share of the many so-called ‘independent labels’ was roughly 38 per cent worldwide in 2016, or some 31 per cent in Germany. As for the major labels, the collapse of the market led to processes of consolidation in practically all national markets, so that only three are now currently active in Germany. All three are organised in the BVMI, along with others, whereas most of the independent labels, as well as independent music publishers, distributors, producers and self-marketing artists, have joined forces in the Association of Independent Music Companies (Verband unabhängiger Musikunternehmen, or VUT).

Music labels generally pre-finance the studio recordings of the artists they have under contract. They then administer the duplication and distribution of the recordings. Their major service resides in marketing and promotion, sometimes including the organisation of concert tours and the manufacture of merchandising products. Alternatively, finished recordings can be incorporated in the label’s own catalogue via so-called master recording agreements. Besides the income from the marketing and direct sale of recordings and digital music products, the record manufacturers and independent producers gain revenue from GVL royalties and licensing revenue from merchandising.

The recordings themselves are produced in rented or self-operated studios, of which there were some 700 companies subject to turnover tax in 2016 (compared to 540 in 2010). Nonetheless, between 2010 and 2016 the number of newly released music albums in Germany dropped by 10 per cent (pop) and nearly 30 per cent (classical), whereas the percentage of revenue from foreign music productions steadily increased for the same period. In other words, there is growing competition within a potentially shrinking sub-market. The production and duplication (‘pressing’) of physical recordings (mainly CDs or vinyl discs) are carried out by specialist pressing plants whose number and revenue have sharply declined in recent years with the decreasing sales figures for physical recordings. In the sale of physical recordings, the roughly 390 retailers specialising in audio and visual recordings have always played a subordinate role compared to department stores and consumer electronic stores. Their decline has continued in recent years. In 2016, according to information from the BVMI, 98.5 per cent of all revenue from recordings was achieved in other forms of bricks-and-mortar retail stores (62 per cent) or from digital distibutors (36.5 per cent). [20]

All in all, the market for recorded music has stabilised in recent years, but it is foreseeable that the on-going trend toward digital music products and streaming will continue. All companies in Recorded Music involved in the production and marketing of physical recordings must therefore reckon with a further decline in demand. At the same time, the market power of streaming services will grow, so that the future scale of new products will depend on how much streaming revenue is passed on to producers.

Music Publishers

In 2016 the roughly 1,070 music publishers in Germany had nearly 3,400 employees, 200 more than in 2010. Since then the number of publishers has declined by 80. The traditional activities of music publishers are centred on printing and marketing sheet music. Usually this is not done via the book trade but via specialist music dealers, some of whom also sell musical instruments (see below). The range of publishers’ activities has constantly expanded over the last few decades. According to a membership poll conducted in 2017 by the German Music Publishers Association (Deutscher Musikverleger-Verband, DMV), the sheet music business (purchases by private households plus sales and rentals to performers, music schools and the self-employed) made up less than 10 per cent of total revenue, which amounted to nearly €700 million in 2016. The consumer polls of the Federal Statistical Office reveal that private households spent roughly €50 million on sheet music and textbooks in 2016, a figure that has remained largely unchanged since 2010.

However, the bulk of music publishers’ revenue comes from the licensing business, which has been growing steadily for years. For this purpose, lyricists, songwriters and composers sign collection agreements with a music publisher for the various ways in which their works are exploited. Among them is the utilisation of songs or compositions in films or computer games, for which users must acquire appropriate licences from the publisher. Similarly, most stage works are licensed via music publishers.

Frequently part of the collection activities is transferred to GEMA, whose income amounted to roughly half of the music publishers’ total licensing proceeds in 2016. In foreign countries, the rights are likewise administered by GEMA, which receives dividends from its affiliates for the use of its repertoire, or by foreign-based sub-publishers that manage their own licensing business or have their rights administered by the national collecting society of the country concerned.

The future evolution of the Music Publishers segment will depend heavily on the evolution of copyright law, the core of which is decided at the EU level, and the interpretation of which is influenced by the decisions of the European Court of Justice and the German courts.

Collecting Societies

In Germany, the legislation regarding copyright and other forms of intellectual property protection (Gesetz über Urheberrechte und verwandte Schutzrechte, UrhG) supplies a legal framework for scholarly and cultural achievements in literature, science and the arts, and thus for remuneration claims resulting from the performance of works of music, the manufacture of audio recordings and digital music products, and the broadcasting of music programmes. As it is impossible for authors and holders of ancillary rights to conclude contracts with everyone who uses their musical works and productions, much less to monitor whether such contracts are correctly upheld, collecting societies have arisen to gather together the licensing claims of large groups of copyright holders. For the music economy, these are primarily GEMA and GVL, but also include the German Music Collecting Society (VG Musikedition).

GEMA represents the authors of musical works in the upholding of their rights. Some lyricists, composers and arrangers in turn transfer the administration of their rights to music publishers, who then retain part of the artist's revenue from GEMA. Moreover, GEMA’s field service takes on some of the licensing services for GVL and other collecting societies. In 2016 the income from rights, without debt collection mandates, amounted to €850 million, and thus 25 per cent more than in 2010. [21]

GVL represents music practitioners and audio recording producers in administering their rights from the use of recorded music. The dividends to each group are roughly equal, and GEMA takes over some of the debt collection procedures on commission from GVL. In 2016 the income from rights amounted to €270 million. [22] Compared to 2010, this represents an increase of 50 per cent. However, the 2016 figures also include back payments of duties levied on the manufacturers of mobile end devices from previous years. Without these special revenues, the increase over 2010 would have amounted to roughly 35 per cent.

By ensuring that musicians receive regular income, the collecting societies are a significant economic factor in their own right. Taken together, GEMA and GVL had almost 1,000 employees at the end of 2016.

Musical Instruments and Music Retailers

Companies in the Musical Instruments sub-segment can be divided into three main activities:

- Manufacture of musical instruments and equipment (MI branch). In 2016, according to turnover tax data from the Federal Statistical Office, Germany had almost 1,300 mainly small to medium-size companies in this area, which is noteworthy for its high degree of specialisation and above-average interweaving in imports and exports alike.

- Sale of musical instruments and equipment, mainly via some 1,700 specialist retail outlets (bricks-and-mortar and online shops). Usually the shops also carry sheet music, music books, songbooks and DVDs in their assortment.

- Manufacture of studio and theatre equipment and sales of products to professional customers, usually via their own sales departments.

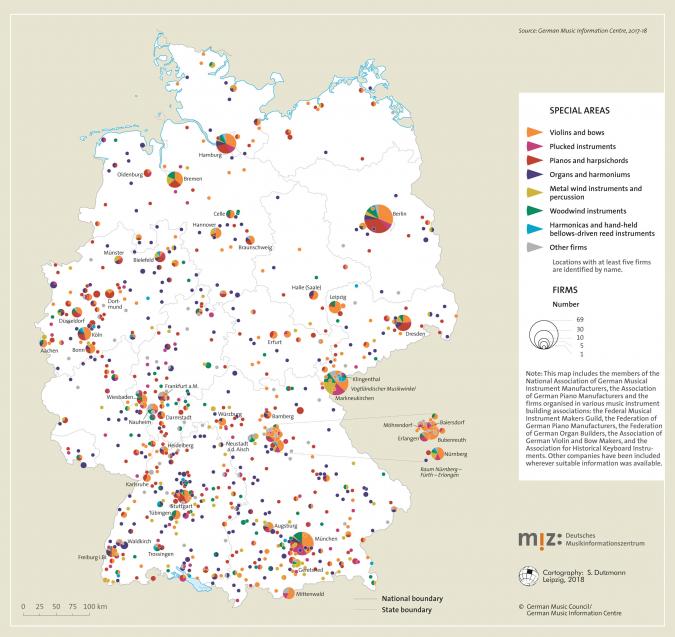

No segment of the music economy has such a high percentage of exports in domestic production, or imports in domestic demand, as Musical Instruments. In 2016 Germany’s instrument manufacturers produced total revenue of €640 million, a 16 per cent increase over production revenue in 2010. At the same time, musical instruments were exported for €555 million and imported for €585 million. Admittedly this branch is subject to growing competition, especially from Asian manufacturers. But foreign trade statistics for 2010 to 2016 do not suggest a trend toward steadily increasing import surpluses. Years with slight deficits alternate with years of slight surpluses. [23] Instrument building has a long history in Germany. It consists chiefly of highly specialised industrial and artisanal companies that manufacture traditional instruments, both big and small, as well as electronic instruments. Some of them are organised in the National Association of German Musical Instrument Manufacturers (Bundesverband der deutschen Muskinstrumentenhersteller, or BDMH), while the Federal Musical Instrument Makers Guild (Bundesinnungsverband für das Musikinstrumenten-Handwerk, or BIV) represents the interests of Germany’s 13 guilds, which in turn represent artisanal workshops from the whole of Germany. The production sites are located not only in large cities but also in rural areas such as Vogtland, some of which specialise in particular groups of instruments (see Fig. 3).

According to consumer polls of the Federal Statistical Office, private consumers in Germany spent approximately €600 million on musical instruments and accessories in 2016. To this must be added the demand from companies and institutions of the music economy, e.g. private and public (music) schools, practicing artists, event organisers, recording studios and so forth. The Society of Music Merchants (SOMM), representing the interests of some 60 musical instrument companies active in manufacturing, distribution, trade and media, and thus about two-thirds of Germany’s musical instrument market, gives a figure of €960 million in revenue for sheet music, musical instruments and professional studio and theatre equipment in 2016, [24] an increase of 10 per cent over 2010.

Unlike the market for recorded music, musical instruments are still sold mainly via specialised retail shops, of which some 60 per cent are organised in the German Music Retailers Association (Gesamtverband Deutscher Musikfachgeschäfte, or GDM). By 2016 the total revenue from music retailers, including other product groups, had grown to €1.35 billon, 14 per cent more than in 2010. At the same time the number of retail shops had declined by 20 per cent, one reason being that parts of the assortment are increasingly being purchased online, placing small dealers in particular under pressure.

Relevance to the national economy

The Federal Statistical Office most recently published figures for 2015 regarding the gross value-added and number of employees in all major sub-areas of the media economy. [25] According to these figures, the gross value-added of the music economy (using the broad definition given in the MW Study) amounts to €3.9 billion, or roughly that of the film industry. Revenues from the music economy are greater than those of radio broadcasters (€1.85 billion), book publishers (€2.05 billion) and newspaper publishers (€2.95 billion), but less than those of television broadcasters (€6.35 billion) and magazine publishers (€4.2 billion). Owing to the large number of microenterprises in the Creative Artists and Music Teaching sub-segments, the number of employees is higher than in any other media branch: newspaper publishers (73,500), film industry (64,300), television broadcasters (30,300), book publishers (24,100) and radio broadcasters (11,900).

Demand in other branches and spillover effects

The business activities of music companies spill over into other areas of the economy. For one thing, supplier services are in demand from companies outside the music economy, so that music production also gives rise indirectly to revenue and employment in other industries. According to the polls in the MW Study, such supplier services were created by roughly 17,000 employees in 2014, yielding roughly €1.1 billion in profits and salaries from production (in addition to the €3.9 billion in value-added inside the music economy). Branches of the economy that utilise music intensively in their own products (especially clubs, producers of audio-visual media content or audio consumer electronics), taken together, generate almost €15 billion in revenue each year.

More than 71 million concertgoers in Germany in 2016 prove that music tourism is gaining in importance. Visits to music events generally involve not only ticket purchases but other expenses, such as transportation costs and outlays for restaurant services and merchandising products at the performance site. If the distance to the venue is very far, accommodation expenses may also be involved. Polls on average expenditures for day trips and short vacations connected with concert visits show that concerts generate some €1.1 billion (day trips) or €4.5 billion (short trips) in expenses per year. [26]

Summary and future outlook

The KKW Monitor allows us to compare developments in the music economy with those of the creative economy, or the economy as a whole, with regard to number of companies, revenue and number of employees from 2010 to 2016. We arrive at the following conclusions:

- The number of companies in the music economy has grown by 5 per cent since 2010, more than in the economy as a whole (3 per cent) and almost as much as in the entire creative economy (6 per cent).

- The growth in revenue during the same period was 13 per cent (see Fig. 1), and thus slightly less than that of all companies in the creative economy or the economy as a whole (both approx. 16 per cent).

- The number of employees in the music economy has grown by 7 per cent since 2010, and thus just as much as in the entire creative economy, but not quite as much as in the economy as a whole (10 per cent).

All in all, the figures reflect a stable positive trend for the music economy, even if some of its activities and employees are excluded by the narrow definition given in the KKW Monitor. Moreover, there are considerable positive spillover effects on other industries of the national economy, a fact that drew appreciative comments from politicians at the first music economy summit in June 2018. Future growth opportunities will be decisively influenced by efforts to solve the longstanding problem of precarious income among a great many creative artists (proper involvement in licensing income) and freelance music teachers (proper payment for instruction).

The music economy is undergoing structural changes in all its sub-segments. These changes, resulting especially from digitisation, have already led to sharp differences in growth and have influenced growth potential in every sub-segment. If expenses from private consumers for active music-making have remained stable since 2010, those for music reception have undergone a marked shift from recorded music to live music. This is also reflected in the development in number of employees: if the Live Music segment has grown by 19 per cent in this respect since 2010, Recorded Music has shrunk by 21 per cent. The ongoing trend in recorded music from physical recordings to the reception of digital products will lead to further downturns in production and sales for physical recordings. At the same time, the level reached in prices for concert tickets will undoubtedly limit the speed of growth in the Live Music segment.

Footnotes

- Federal Statistical Office, Laufende Wirtschaftsrechnungen Einkommen, Einnahmen und Ausgaben der privaten Haushalte 2016, special series 15, series 1 (Wiesbaden, 2018), with additional subdivision for consumption by SEA code.

- Roughly half of the artistic and technical staff and half of the income from publicly funded multi-genre theatres should be assigned to the music sector.

- The official classification system for branches of the economy refers to record companies as ‘Publishers of Sound Recordings’ (Verlage von bespielten Tonträgern).

- Brand name for the marketed repertoire (often a particular style).

- Cultural and Creative Economy Working Group in the Conference of Economic Ministers, Leitfaden zur Erfassung von statistischen Daten für die Kultur- und Kreativwirtschaft (version of 2016), short introduction online at https://www.wirtschaftsministerkonferenz.de/WMK/DE/termine/Sitzungen/16-06-08-09-WMK/16-06-08-09-bericht-leitfaden-ak-kultur-kreativwirtschaft-10.pdf?__blob=publicationFile&v=2 (accessed on 4 June 2018).

- See the definition of the federal government’s Cultural and Creative Economy Initiative at https://www.kultur-kreativ-wirtschaft.de/KUK/Navigation/DE/DieBranche/Uebersicht/uebersicht.html (accessed on 4 June 2018).

- Federal Ministry of Business and Energy, ed., Monitoringbericht Kultur- und Kreativwirtschaft 2017 (Berlin, 2018), online at https://www.bmwi.de/Redaktion/DE/Publikationen/Wirtschaft/monitoringbericht-kultur-kreativwirtschaft-2017.html (accessed on 7 November 2018).

- Federal Music Industry Association et al., eds., Musikwirtschaft in Deutschland: Studie zur volkswirtschaftlichen Bedeutung von Musikunternehmen unter Berücksichtigung aller Teilsektoren und Ausstrahlungseffekte (Berlin, 2015), online at http://www.musikindustrie.de/fileadmin/bvmi/upload/06_Publikationen/Musikwirtschaftsstudie/musikwirtschaft-in-deutschland-2015.pdf (accessed on 14 May 2018).

- The sole exception is the business branch ‘Provision of services for the performing arts’, which is assigned not only to the music market but also to the market for the performing arts.

- If record companies conducted all of their production and marketing activities for digital music products in-house, the total revenue from all companies in the Recorded Music sub-segment would, for example, be much lower than if they drew their services from self-employed specialists (sound studios, music producers, pressing plants, marketing companies and retailers).

- Some 800,000 individuals (1 per cent of the population) are polled annually in the microcensus, which, however, only roughly estimates the business branches in which employees and the self-employed are active. See Federal Statistical Office, Beschäftigung in Kultur und Kulturwirtschaft: Sonderauswertung aus dem Mikrozensus 2015 (Wiesbaden, 2015).

- The German Music Information Centre has processed the current data and presented it online at estimates (accessed on 4 June 2018).

- However, microbusinesses and marginal part-time employees in the music market are merely given rough estimates and not divided among the sub-segments of the music economy.

- The situation of teachers is discussed in Jürgen Simon, Einkommenssituation und Arbeitsbedingungen von Musikschullehrkräften und Privatmusiklehrern 2017: Umfrage der Fachgruppe Musik der ver.di von Juli 2017 – September 2017, online at http://www.miz.org/downloads/dokumente/910/2017_Umfrage-Musikschullehrkraefte_verdi.pdf (accessed on 14 August 2018).

- Current data at http://www.miz.org/downloads/statistik/125/125_Einnahmen_und_Ausgaben_der_Musikschulen_im_VdM.pdf (accessed on 14 August 2018).

- On 1 January 2019 the bdv merged with the Association of German Concert Agencies, or VDKD. According to the bdv, the new association represents ‘100 per cent of the business sector beneath a single roof’. In September 2018 the bdv and VDKD, taken together, had nearly 500 agencies and tour and concert organisers in their membership.

- Bundesverband der Veranstaltungswirtschaft , ed., Live-Entertainment in Deutschland: Eine Studie der Gesellschaft für Konsumforschung (GfK) (Hamburg, 2018).

- Not included are publicly operated (music) theatres and concert halls as well as orchestras largely financed with public funds.

- See also Jens Michow and Johannes Ulbricht, Veranstaltungsrecht: Recht der Konzert- und Unterhaltungsveranstaltungen (Munich, 2013), para. 41ff. and 65ff.

- See Federal Music Industry Association, ed., Musikindustrie in Zahlen 2017 (Berlin 2018), p. 36, online at https://www.musikindustrie.de/fileadmin/bvmi/upload/02_Markt-Bestseller/MiZ-Grafiken/2017/BVMI_ePaper_2017.pdf (accessed on 14 June 2018).

- GEMA, ed., Geschäftsbericht mit Transparenzbericht 2017 (Berlin 2018), online at https://www.gema.de/die-gema/publikationen/geschaeftsberichtransparenzbericht (accessed on 21 June 2018).

- Gesellschaft zur Verwertung von Leistungsschutzrechten, ed., Geschäfts- und Transparenzbericht 2016, online at https://gvl.de/gvl/presse-und-publikationen/publikationen (accessed on 14 June 2018).

- Federal Statistical Office, Außenhandel – Zusammenfassende Übersichten für den Außenhandel – endgültige Jahresergebnisse 2013 und 2016, special series 7, series 1 (Wiesbaden, 2018).

- Press release from SOMM, ‘Musikinstrumentenmarkt verzeichnet weiterhin Zuwächse’ (4 March 2017).

- Federal Statistical Office, Strukturerhebungen im Dienstleistungsbereich Information und Kommunikation 2015, special series 9, series 4.2. The KKW Monitor likewise estimates data for gross value-added from all sub-markets on the basis of employment figures. However, these data are far higher than the figures from the Federal Statistical Office.

- Musikwirtschaft in Deutschland (Berlin, 2015), p. 20.